Expanding

green financial

support

Woori Financial Group is expanding its financial support for eco-friendly businesses and the green-growth industry. To this end, the company has designated its Green Finance Department as the Corporate Customer Department and Corporate Banking Solution Department to further expand the driving force behind green growth. Corporate Customer Departmnet supports government policies through support for renewable energy companies and also supports new growth engines and sustainable projects. It plays the role of providing advanced financial support. In particular, through relevant departments, we have designated industry-specific classification codes for detailed items related to new growth engines, and based on these, we are continuously expanding support for new high-quality customers and partner companies.

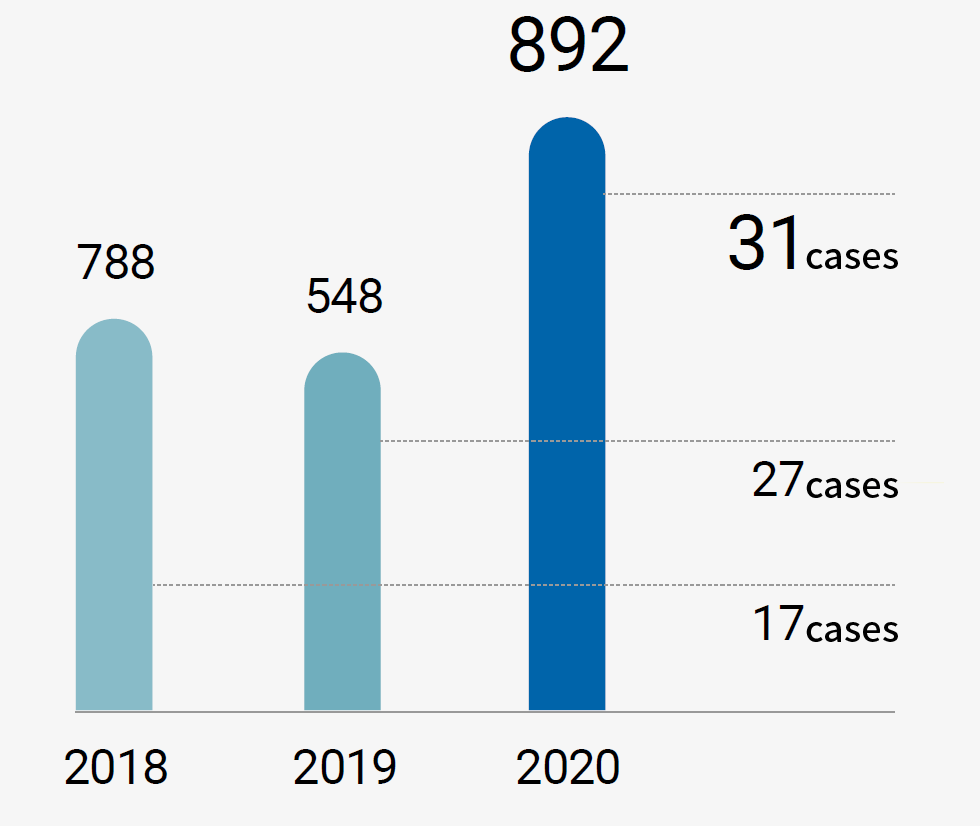

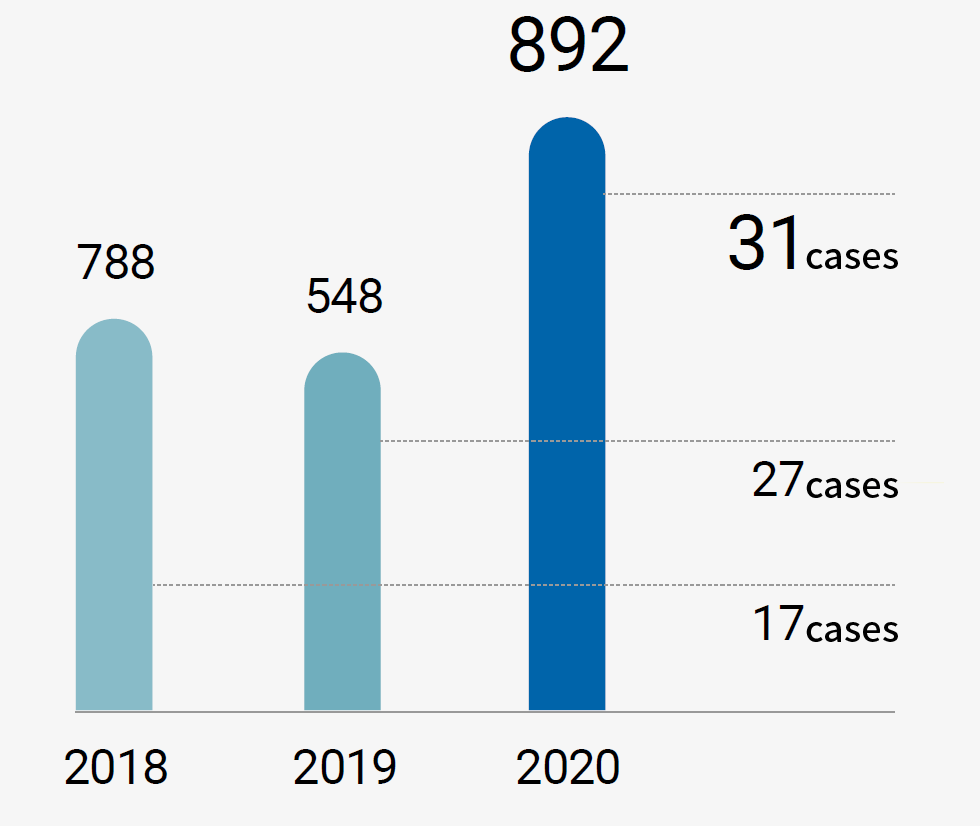

Number of green financial support cases and amount of support (Unit: KRW 100 million)

Green Finance Topics

| Classification | Main Contents | Main products |

|---|---|---|

|

New & Renewable Energy |

Development of new & renewable energy, investment related to power generation Wind power, photovoltaic power and biomass, etc. |

· The Cheongsong Noraesan Wind Power Plant Project · The Saemangeum Onshore Solar Power Zone 1 Power Generation Project · Japan Yokkaichi Photovoltaic Power Project |

|

Eco-friendly Infrastructure |

Investment and loan made to increase environmental efficiency |

· Investments related to water & sewage treatment facilities, resource recovery facility and enviromental facilities |

| Green Building |

Investment or loan for eco-friendly (Green) architecture such as LEED-certified building, etc. |

· Woori Green Remodeling Loan - Product specializing in improvement funds related to the Green Remodeling Project by the Government · Climate Change Funds by the Seoul Metropolitan Government - Housing Energy Efficiency Project |

|

Green Transportation |

Financing on the purchase of eco-friendly vehicles and infrastructure on low-emission transportation methods |

· Woori Dream Car Loan: A special rate of 0.7%p is applied for the annual interest rate for eco-friendly vehicles (electric, hydrogen energy and hybrid, etc.) |

Project Financing(PF)

Based on Equator Principles

Woori Financial Group is trying to reduce the environmental impact of PF as much as possible. For PF subject to the Equator Principles, an environmental and social risk review framework shall be applied to the project. For PF businesses, when checking compliance with the ESG Financial Principles, internal experts who have not participated in the PF project monitor compliance with the ESG framework, including environmental or social impacts. In addition, we conduct on-site inspections by external experts to review environmental and social risks.

Woori Bank adopted Equator Principles : (August, 2021)

Woori Bank adopted Equator Principles : (August, 2021)

CASE PF with Equator Principles Framework

|

CASE

PF with Equator Principles Framework

Case 1. Cheongsong Noraesan Wind Power Plant ProjectThe Cheongsong Noraesan Wind Power Plant Project is a renewable energy PF project in which Cheongsong Noraesan Wind Power Co., Ltd., built and is operating a 19.2MW wind farm in Cheongsong-gun, Gyeongbuk. Out of the total project costs of KRW 43.1 billion, the group provided KRW 10 billion in PF loans. This investment will be recovered in installments over the period of about 16 years, from October 2020 to April 2036, depending on the power sales generated by wind power generation. Hyundai E&C and the project owner conducted an appropriate environmental impact survey in consultation on the environmental social impact assessment of the relevant project, and the number of management plans accordingly; We are continuing to monitor related environmental impacts. |

|

Case 2. Saemangeum Onshore Solar Power Zone 1 Power Generation Project The Saemangeum Onshore Solar Power Zone 1 Power Generation Project is a renewable energy PF project in which Saemangeum Hope Solar Power Co., Ltd., built and is operating a 99 MW onshore solar power plant on an area of reclaimed land in Gunsan, Jeonbuk. Out of the total project costs of KRW 157.5 billion, the group provided KRW 42.5 billion in PF loans. The investment will be recovered in installments based on electricity sales generated from solar power over a period of about 15 years from December 2020. This project is a solar power generation project that is being carried following the declaration of a renewable energy vision for Saemangeum, and the solar power plant is installed on the reclaimed land behind the Saemangeum Seawall, so the environmental impact on forests is minimal. The national and local governments will take the lead in licensing and construction in consideration of its environmental impact and with the participation of local residents. |

|

Case 3. Gimhae Daedong High-tech Industrial Complex Creation Project The Gimhae Daedong High-Tech Industrial Complex Development Project is a large-scale public-private joint development project led by Gimhae City, with the city making the largest direct investment with the project operators. Woori Financial Group provided a total of KRW 400 billion in senior loans and KRW 80 billion in PF loans. The loans will be withdrawn in installments for one year from September 2020, and will be recovered from sales proceeds after the completion of the project. Dohwa Engineering conducted an environmental impact assessment related to this project, and we will establish and implement measures to minimize possible environmental and ecological impacts, such as water pollution, ecological impact, etc |