Financial support for disadvantaged community members

Woori Financial Group has expanded financial services to support disadvantaged community members.

Woori Bank expanded the following products to support stable small-loan financing:The New Hope Spore Loan (credit loan to financially support low-credit, low-income customers), the Bridge Mid-Interest Rate Loan, and the Sunshine Loan 17 (formal financial product for lowest credit customers who have a job and income).

In April 2020, the Woori New Hope Spore Loan has improved its interest rate (blanket application of 0.2% → 0.3%) for multicultural families, families with more than 3 children, disabled people, youth (29 years old or less), and seniors (65 years or older) for the mitigation of financial expenses. By actively utilizing “untact” (contactless) channels, we have rapidly increased the amount of handled in untact mode from 34.1 billion KRW in 2019 to 118.3 billion KRW in 2020. Meanwhile, the cost of business derived from the increased loan has been reduced. We have thus simultaneously achieved the vitalization of microfinancing and enhancement of business efficiency.

Also, through Sunshine Loan 17, we have committed our strongest effort to resolve the problem of polarization in the field of finance by providing microfinancing support for people who were unable to receive the benefits of a formal financial system and were vulnerable to high-interest loans as exist in the private credit industry, etc. Along with the introduction of Sunshine Loan 17 in September 2019, the Switch-Over Dream Loan was ended, and the role of loans for the repayment of a high-interest loans from the private loan industry which had been performed by Switch-Over Dream Loan is now to be performed by Sunshine Loan 17, which supports loans for livelihood funds and expands the range of eligible people. Whereas the amount of support provided by the existing Switch-Over Dream Loan was 15.3 billion KRW in 2019, the amount of support through Sunshine Loan 17 in 2020 is 107 billion KRW, and the amount of microfinancing has been drastically expanded. Notably, untact channels were made available in February 2002 to improve user convenience and expand the supply. The Bridge Mid-Interest Rate Loan is an untact exclusive loan for customers with a salary, business or pension and a rating of higher than 7 grade. It was introduced in July 2016, and is a mortgage loan on the guarantee of Seoul Guarantee Insurance Company, with a relatively low-interest rate in comparison with other microfinancing products.

Woori Bank financed 409.3 billion KRW to approximately 32,000 customers in 2020 through the Credit Loan 119 Program. The Credit Loan 119 Program is a system that guides and provides consultation to potentially delinquent debtors whose credit rating has been drastically reduced or who have multiple loans, and supports an extension of the expiration date of their loans and converts them to long term amortizing loans (including small-loan financial products).

In April 2020, the Woori New Hope Spore Loan has improved its interest rate (blanket application of 0.2% → 0.3%) for multicultural families, families with more than 3 children, disabled people, youth (29 years old or less), and seniors (65 years or older) for the mitigation of financial expenses. By actively utilizing “untact” (contactless) channels, we have rapidly increased the amount of handled in untact mode from 34.1 billion KRW in 2019 to 118.3 billion KRW in 2020. Meanwhile, the cost of business derived from the increased loan has been reduced. We have thus simultaneously achieved the vitalization of microfinancing and enhancement of business efficiency.

Also, through Sunshine Loan 17, we have committed our strongest effort to resolve the problem of polarization in the field of finance by providing microfinancing support for people who were unable to receive the benefits of a formal financial system and were vulnerable to high-interest loans as exist in the private credit industry, etc. Along with the introduction of Sunshine Loan 17 in September 2019, the Switch-Over Dream Loan was ended, and the role of loans for the repayment of a high-interest loans from the private loan industry which had been performed by Switch-Over Dream Loan is now to be performed by Sunshine Loan 17, which supports loans for livelihood funds and expands the range of eligible people. Whereas the amount of support provided by the existing Switch-Over Dream Loan was 15.3 billion KRW in 2019, the amount of support through Sunshine Loan 17 in 2020 is 107 billion KRW, and the amount of microfinancing has been drastically expanded. Notably, untact channels were made available in February 2002 to improve user convenience and expand the supply. The Bridge Mid-Interest Rate Loan is an untact exclusive loan for customers with a salary, business or pension and a rating of higher than 7 grade. It was introduced in July 2016, and is a mortgage loan on the guarantee of Seoul Guarantee Insurance Company, with a relatively low-interest rate in comparison with other microfinancing products.

Woori Bank financed 409.3 billion KRW to approximately 32,000 customers in 2020 through the Credit Loan 119 Program. The Credit Loan 119 Program is a system that guides and provides consultation to potentially delinquent debtors whose credit rating has been drastically reduced or who have multiple loans, and supports an extension of the expiration date of their loans and converts them to long term amortizing loans (including small-loan financial products).

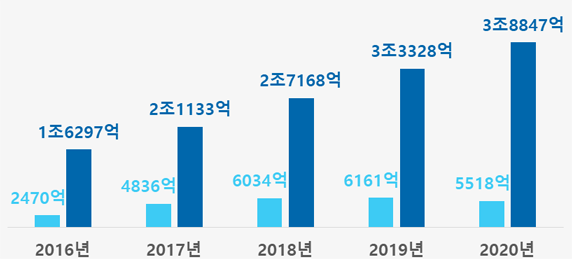

New Hope Spore Loan

Switch-Over Dream Loan + Woori Sunshine Loan17

(Introduced In September 2019)

NewAccumulatedAs of End of December 2020 / Unit : KRW

Financial Support Related to the COVID-19 Pandemic

Since April 29, 2020, we have implemented a special system for the “free workout” of household loans to support debtors who have had (concerns for) delinquency due to difficulties in repayment of household loans caused by income reduction since the COVID-19 pandemic. This system targets household credit loan products and provides preemptive financial support to vulnerable /or delinquent borrowers who are experiencing financial difficulties due to the COVID-19 pandemic, by means of postponement (6 months or 12 months) of the repayment of the principal, extension or pre-agreement on existing loans, and handling of loans for loan repayment. It will proceed through a process similar to that of the Credit Loan 119 Program which had previously been in operation, but the range of eligible targets and products has been expanded. As of the end of 2020, support through this system has amounted to 1.607 billion KRW across 77 cases.

Supporting the Rehabilitation of Delinquent Debtors

In 2017, for the first time among commercial banks, Woori Bank supports the comeback of delinquent debtors by lowering the 7-8% overdue interest on household loans to 3%-5%, with a maximum reduction by 4%. Furthermore, we completed the write-off of receivables of 209.3 billion KRW with the completion of extinctive prescription in 2017. Moreover, the Sunshine Loan 17, a joint policy financial product of financial institutions and the Financial Services Commission, was introduced in September 2019 to help lowest credit holders who had been forced to take loans with a high interest rate from private loaners or illegal private financing to have access to a proper financial institution, which contributes to the stabilization of people's livelihoods.

In February 2020, we implemented a project to provide free support of agents and attorneys at law for debtors. For vulnerable debtors suffering from highest interest rates and the malicious means of demanding payment of debt, etc., the attorneys from the Legal Aid Corporation will represent on behalf of the debtor for the entire collection process and support legal proceedings, etc. for damage relief, free of charge.

In February 2020, we implemented a project to provide free support of agents and attorneys at law for debtors. For vulnerable debtors suffering from highest interest rates and the malicious means of demanding payment of debt, etc., the attorneys from the Legal Aid Corporation will represent on behalf of the debtor for the entire collection process and support legal proceedings, etc. for damage relief, free of charge.

Woori Smile

Microcredit Bank

Woori Smile Microcredit Bank will work together with our clients to offer supportive finance.

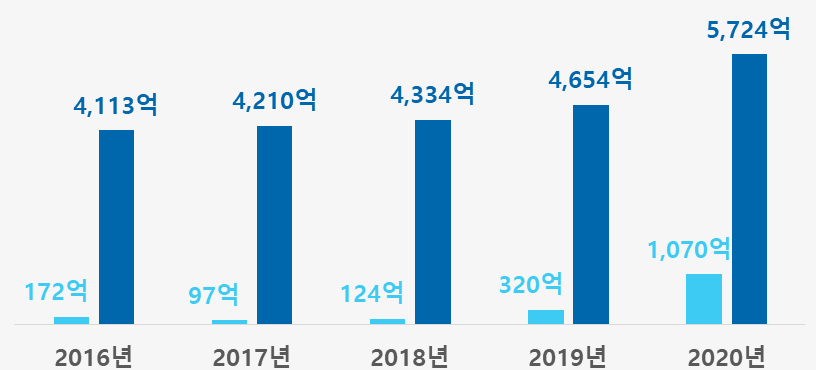

Woori Bank established Woori Smile Microcredit Bank, the first of its kind in the South Korean financial industry, on December 17, 2009, to pioneer new paths in South Korea’s microcredit business. We opened 10 branch offices and sub-branches nationwide to support microcredit for financially disadvantaged groups.

We offer start-up funds and emergency operation funds for small business operators through the Smile Financing Service and provide small amounts of emergency livelihood funds to financially disadvantaged groups. Notably, Woori Smile Microcredit Bank leads in supporting operational funds for non-registered business operators and purchasing funds for vehicles required for livelihood, reflecting our continuous support for financially disadvantaged clients who work in traditional markets. Our support has reached a total accumulated amount of 176.9 billion KRW as of December 2020 (14.7 billion KRW in 2020).

We offer start-up funds and emergency operation funds for small business operators through the Smile Financing Service and provide small amounts of emergency livelihood funds to financially disadvantaged groups. Notably, Woori Smile Microcredit Bank leads in supporting operational funds for non-registered business operators and purchasing funds for vehicles required for livelihood, reflecting our continuous support for financially disadvantaged clients who work in traditional markets. Our support has reached a total accumulated amount of 176.9 billion KRW as of December 2020 (14.7 billion KRW in 2020).