Group Global

Anti-Corruption Laws Compliance Manual

Chapter 1 General Provisions

Article 1(Purpose)

The purpose of this Manual is to establish standards and procedures for compliance with the Republic of Korea’s Improper Solicitation and Graft Act (the “Anti-Graft Law”), the U.S. Foreign Corrupt Practices Act (“FCPA”), the UK Bribery Act, and other applicable laws around the world prohibiting bribery and corruption (“Anti-Corruption Laws”) by all officers and employees of Woori Financial Group (the “Holding Company”) and its subsidiaries (which includes direct and indirect subsidiaries as defined under Article 4, Paragraph 1, Item 2 of the Financial Holding Company Act, collectively referred to, together with the Holding Company, as the “Group” and each such company in the Group, a “Group Company”) and anyone performing services on behalf of any Group Company (a “Representative”).

Article 2(Defined Terms)

Terms used in this Manual are defined as in the following items.1. “Public Official” means a person who falls in any of the following categories:a. officers and employees of the National Assembly, Courts, the Constitutional Court, Election Commissions, the Board of Audit and Inspection, the National Human Rights Commission, central administrative agencies (including institutions affiliated with the office of the President and the office of the Prime Minister) and their affiliated institutions, and local governments (excluding, however, fixed-term and contract workers who are not public officials under applicable public officials laws); b. officers and employees of public enterprises (government ministry-type, stock company-type, corporation-type);c. appointed public officials and candidates for public office; d. political party employees and officials;e. officers and employees of a public international organization, such as the World Bank and the United Nations;f. employees of sovereign wealth funds;g. other persons performing public duties on behalf of the persons listed in a. through b. above;h. other persons deemed as Public Officials or equivalent to Public Officials according to local law in the applicable country.2. A “Representative” is any person, group or legal entity that is not an officer or employee of the Group and that has been delegated to and performs services on behalf of the Group or promotes or sells Group products and services, and in the course of performing such work and services, interacts with Public Officials.3. “Items of Value” include money, gifts, meals, entertainment, securities, travel expenses, discounts on products and services, donations to charity, assumption or exemption of debt, all property interests, job provision, and other tangible and intangible economic benefits.4. References to “payments” include not only payments made directly by employees of the Group, but also payments made through third parties such as Representatives.

Article 3(Obligation to Comply)

All Group officers and employees shall faithfully adhere to this Manual in conducting work.

Chapter 2 Officer and Employee Action Policy

Article 4(Prohibition of Improper Solicitation and Provision of Bribery)

① Group officers and employees are strictly prohibited from providing bribes to Government Officials, and are also prohibited from providing kickbacks or engaging in other improper inducements. ② Group officers and employees are prohibited from doing the following, whether directly or through a third party: 1. provide to or solicit from a Public Official any Item of Value with improper intentions for a business advantage;2. induce any Public Official to violate his or her duties for a business advantage;3. offer, promise, disburse, payment of, or authorize provision of Items of Value to improperly reward any Public Official for past conduct;4. provide or solicit any Item of Value for any other improper advantage.③ No Group Company may take adverse action against an officer or employee for adhering to this Manual, even if this results in the loss of business opportunities, etc.④ Group officers and employees may also not use personal funds or resources to accomplish any actions enumerated in Item 2.

Article 5(Prior Consultation)

① Whether an Item of Value is permissible for a Group Company to provide will depend on the specific facts and surrounding circumstances within the limits permitted under the applicable country’s law, and if you are unsure whether the provision of an Item of Value may violate this Manual, you must consult with your Group Company compliance monitoring department.② The Group Company compliance monitoring department may seek the opinion of the Compliance Support Department of the the Holding Company when necessary.

Article 6(Insider Reporting, etc.)

① If a Group officer or employee becomes aware of conduct that may violate this Manual, he/she must report it, in accordance with his/her Group Company’s Whistleblowing Report Regulation, to the department responsible for whistleblowing or to the compliance monitoring department of such Group Company.② The intake, investigation, processing, whistleblower protection, etc. relating to matters reported pursuant to Item 1 above shall be handled in accordance with each Group Company’s internal regulations and the responsible department of such Group Company that receives the report shall promptly notify the contents to the Compliance Support Department of the Holding Company.③ Each Group Company must maintain confidences and must prohibit any retaliatory action against any officer or employee who makes a report under Item 1 above.④ The Group Company compliance monitoring department or the Compliance Support Department of the Holding Company may operate a channel to intake tips or reports related to this Manual, and upon receipt of a tip or report, may conduct an inspection and investigation into the relevant matter regarding compliance with laws and may request an inspection by the applicable Group Company audit department if necessary.⑤ Items 2 through 4 above all apply in equal measure to cases where a Representative makes a report in accordance with Item 1 above.

Chapter 3 Scope of Application

Article 7(Requirements for Providing Benefits to Public Officials)

① The provision of Items of Value to Public Officials in connection with Group business activities must be recorded in the Expense Payment Checklist found in Appendix 6, and particular attention must be given that payment or provision is within the permissible scope under the Anti-Graft Law and relevant laws of each applicable country. ② It is prohibited to provide benefits to a Public Official as a reward for any particular business advantage or benefit from such person, such as approving a license, accreditation or permit, altering the results of an inspection or audit, affecting the outcome of a legal action, or any other benefit.③ At least one Group officer or employee must be present in the case of any meal or entertainment offered that is incidental to business activities.

Article 8(Procedures for Providing Benefits to Public Officials)

① Prior consultation must be had with the Group Company compliance monitoring department, in accordance with Article 5, Item 1, when considering providing Items of Value to Public Officials exceeding the limits permitted by the laws of each applicable country.② When making payments for expenses or fees, Group Company officers and employees must indicate that the payment voucher is for disbursement relating to a Public Official and must indicate on such voucher the recipient’s organization and position, the recipient’s name, and the relevant Group Company officer(s) or employee(s).

Article 9(Principles for Payment of Travel, Accommodation, and Related Expenses)

① Payments may not be made for a Public Official’s travel, accommodation or related expenses, either directly or indirectly, in exchange for any business advantage or benefit.② Notwithstanding Item 1 above, payments may be made for a Public Official’s travel, accommodation and related expenses only if all of the following circumstances are present:1. the Group Company is bearing the expenses pursuant to contract or in exchange for the Public Official’s performance of his lawful duties;2. the cost is reasonable given the recipient’s position;3. no friends, family, or extended family of the Public Official are traveling at the Group Company’s expense; 4. no tourist activities or events are planned that are not directly connected to the business purpose of the travel, unless such activities or events are at the expense of the Public Official and results in no additional cost to the Group Company;5. the payment amount is legal under local law of the Public Official’s home country;6. the payment amount is permissible under the internal rules of the Public Official’s agency or organization.

Article 10(Procedures for Payment of Travel, Accommodation, and Related Expenses)

① All payments for travel, accommodation or related expenses of any Public Official must be approved in advance by the Group Company compliance monitoring department.② If the Public Official’s disbursements are less than the amount of payments made by the Group Company for travel, accommodation or related expenses, the Group Company must be reimbursed by the Public Official for the difference.③ Representatives that deal with Public Officials on a Group Company’s behalf must comply with Article 8, and must comply with Article 9 when matters related to a Public Official’s travel are included in the scope of delegation.

Article 11(Hiring a Public Official or Relative of a Public Official)

① It is prohibited for a Group Company to provide a job, internship, or other employment-related opportunity to a Public Official, or a member of a Public Official’s family, in order to gain influence with the Public Official.② If a Public Official recommends a candidate and offers to give a benefit to the Group or threatens to take adverse action against the Group in connection with a hiring decision, the candidate recommended by the Public Official will not be hired.③ The Group’s normal hiring procedures must be followed for hiring decisions involving any candidate recommended by or known to be related to a Public Official, and such candidate must be evaluated based on the same criteria as other applicants for the same job.④ Discussions with sitting Public Officials about job opportunities must be pre-approved by the applicable Group Company compliance monitoring department and must proceed in accordance with the internal rules of the Public Official’s organization.

Article 12(Charitable Contributions)

① General charitable contributions should adhere to each Group Company’s policies on the assumption that they will be solely for the purpose of purely charitable contributions. In addition, attention must be paid to the following items with respect to any donation that is requested by a Public Official or would support the activities of a government agency:1. Charitable contributions may never be made as part of an exchange of favors with any Public Official or to obtain some inappropriate benefit.2. If a Public Official has promised any benefit or issued any threat in connection with a contribution request, the request must be denied.3. Cash donations are prohibited and any monetary contribution must be made by account wire transfer.4. Charitable contributions may be made only to legitimate and recognized organizations or entities, and may not be made to an individual or to any personal bank account. ② The following procedures must be followed for contributions requested by a Public Official or government entity:1. Step 1 : Contribution requests must be made in writing by official letters, etc. of the requesting organization.2. Step 2 : When a contribution proposal is made or received, the relevant participating department must complete in advance a Charitable Contribution Pre-Check as found in Appendix 4.3. Step 3 : The relevant participating department must retain and maintain evidentiary materials, such as receipts.

Article 13(Political Contributions)

① No funds, facilities, or services of any kind may be paid or furnished to any candidate or prospective candidate for public office, political party, referendum, or other political initiative, or other form of political campaign without the prior approval of the Group Company compliance monitoring department or the Compliance Support Department of the Holding Company.② Group officers and employees are required to keep all personal political activity separate and distinct from their work duties and within the scope permitted by law.③ Group officers and employees may not make political contributions in exchange for securing an improper benefit for the Group.

Article 14(Grants and Sponsorships)

① General grants and sponsorships should adhere to each Group Company’s policies, but particular attention must be paid to the following items with respect to any grant or sponsorship that, at the request of a Public Official or government agency, would support the activities of a government agency:1. It is prohibited to provide a grant, or sponsor an event, conference, or entertainment in exchange for obtaining any improper advantage for the Group Company.2. Provision of a grant or sponsorship may only be made directly to the organizer or person receiving the grant, and only when such person submits a written request may any such payment be made exceptionally to a representative.② The following procedures must be adhered to for the provision of grants or sponsorships to a Public Official or government entity:1. Step 1 : Grant and sponsorship requests must be made in writing in an official letter of the requester, which must describe the program contents, amount of money, and use of funds.2. Step 2 : When a contribution proposal is made or received, the relevant participating department must complete in advance a Grants and Sponsorships Pre-Check as found in Appendix 5.3. Step 3 : The relevant participating department must retain and maintain evidentiary materials, such as receipts.

Article 15(Representatives)

① Each of the following items must be adhered to when a Representative of the Group interacts with Public Officials: 1. Group officers and employees must confirm that the Representative does not appear to be involved in illegal or unethical activities. 2. Representatives must conduct themselves in accordance with the Group’s Code of Ethics and this Manual, and Group officers and employees may not circumvent this Manual or Group Company policies and procedures by using a Representative to do what they could not lawfully do themselves. 3. Group officers and employees may not give special preference to Representatives recommended by Public Officials, such as provision of improper benefits. 4. Group officers and employees may not make payment or promise of any Item of Value to a Representative except a legitimate payment in exchange for goods or services. Furthermore, any such legitimate payment must also be in an amount that is on level with the fair market value of the goods or services received. 5. The following items must be reported to the Group Company compliance monitoring department if they involve a current or proposed Representative: a. A Public Official recommends a specific Representative and the Group is considering selecting that Representative. b. A selection review of a Representative uncovers unusually close links to a Public Official. c. A Representative has a prior case of paying bribes to a Public Official or engaging in other illegal, unethical, or improper conduct. d. A Representative requests payment in cash for services provided. e. A Representative requests payments be made to another party or to a third-country bank account, without reasonable explanation. ② The following procedures must be followed whenever newly engaging a Representative and prior to renewing, or amending a contract with an existing Representative: 1. The following due diligence must be performed on proposed Representatives: a. Request each proposed Representative to complete the “Representative Questionnaire” found in Appendix 1 and the “Anti-Corruption Practices Pledge” found in Appendix 2. b. The officer or employee managing the Representative may request and conduct due diligence if any suspicious conduct is identified through an integrity review using the Representative Questionnaire. 2. The officer or employee managing the Representative may also apply the procedures in Item 2, sub-item 1 to current Representatives as necessary. 3. All work with Representatives must be governed by written contracts that specify the services to be provided and the amount of compensation to be paid. 4. When Representatives enter into contracts, they must contain the “anti-corruption contractual provisions” found in Appendix 3. 5. Representatives must submit detailed documentation supporting all disbursements and expenses incurred when conducting business and the officer or employee managing the Representative must report any concerns to the Group Company compliance monitoring department. ③ The Group Company Compliance Monitoring Department, upon receipt of report pursuant to Item 1 Sub-Item 5 and Item 2, Sub-Item 5, may conduct an inspection and investigation into the relevant matter regarding compliance with laws and may request an inspection by the audit department if necessary.

Article 16(Mergers, Acquisitions, and Joint Ventures)

① When the Group seeks to merge with or acquire a company or a business, or to enter into a joint venture, the department responsible for the merger, acquisition or joint venture investment must identify and assess potential risks of non-compliance with anti-corruption laws through due diligence process conducted on the acquisition target or joint venture partner. ② For each merger, acquisition, or joint venture investment, the department responsible for the merger, acquisition or joint venture investment must conduct due diligence comparable with the Representative vetting process in Article 15, Item 2 of this Manual as directed by the Group Company compliance monitoring department when conducting the due diligence required by Item 1. 1. The due diligence process must take into account the integrity risk of the target company or joint venture partner, the level of perceived corruption in the market, and customer mix and operational status, etc. 2. The merger, acquisition and joint venture agreements must contain anti-corruption representations and warranties; terms that permit the withholding of payments and/or termination of the agreement in the event of a breach of the agreement; and appropriate indemnification provisions. 3. Post-acquisition, the Group’s anti-corruption policies and procedures must be extended to the target company or joint venture; related training must be provided to officers and employees of the target company or joint venture; and implementation of the anti-corruption policies must be confirmed.

Article 17(Facilitating/Expediting Payments)

①Although it is common in some countries for Public Officials to request small “facilitating” or “expediting” payments which are nominal payments to expedite the performance of routine, non-discretionary government work, it is important to note that it is not allowed under the laws of Korea.② Group officers and employees are prohibited from giving or authorizing any facilitating payment not permitted under applicable law in their respective countries, and even in the event that a permissible facilitating payment is made, must notify the Group Company compliance monitoring department in advance and record the payment amount.

Chapter 4 Miscellaneous

Article 18(Documentation Submission Demands)

The Group Company compliance monitoring department will conduct final assessments of compliance with this Manual and related checklists and may demand submission of related documentation from the applicable department or branch compliance monitoring managers.

Article 19(Document Retention)

All documents and internal control materials generated in compliance with this Manual must be retained for a minimum period of five years.

Article 20(Training)

The compliance monitoring manager shall periodically conduct global anti-corruption training at least once annually and the Group Company compliance monitoring department shall provide support.

Sub-regulations(2020.09.14)

This Manual shall be effective beginning September 14, 2020. However, the effective date of Article 8, Item 2 shall be determined by each Group Company.

Appendix 1. Representative Questionnaire

(with respect to Global Anti-Corruption Law Compliance)

(example)

|

This questionnaire is being conducted in accordance with the Woori Financial Group Global Anti-Corruption Laws Compliance Manual. Please complete the items below completely. |

|||||

|

|

|||||

|

1. Name of Company : |

2. Address : |

||||

|

3. Telephone :

(FAX) : |

4. Email : |

||||

|

5. Business Number : |

6. Corporation Registration Number : |

||||

|

7. Services Provided on Behalf of Client: |

8. Individuals Conducting Work : |

||||

|

(1) Please describe all of the Company’s business activities.

(2) Please describe the Company’s capabilities and experience related to the performance of the above services to be provided on behalf of Client (attach copies of related printed materials as necessary)

(3) Does the Company currently conduct government-related activities? (any interactions with Public Officials?)

(4) Does the Company engage any third parties (sub-contractors, vendors, consultants, etc.)? If yes, please complete item (4-1) as well.

|

|||||

|

(4-1) Do third parties (sub-contractors, vendors, consultants, etc.) conduct government-related activities?

(5) List of persons responsible for work on behalf of the client

(6) List of all affiliated business enterprises (including subsidiaries, parent companies, partnerships, etc.)

(7) To your knowledge, have any of the persons responsible for the work on behalf of the client or any officers of your affiliated business enterprises in the last five years:

① been involved in any litigation or legal proceeding relating in any way to bribery, fraud, money laundering, or a similar offense?

□ Yes □ No

If Yes, please describe in detail below.

(8) To your knowledge, have any third-parties (sub-contractors, etc.):

①been involved in any litigation or legal proceeding relating in any way to bribery, fraud, money laundering, or a similar offense?

□ Yes □ No

If Yes, please describe in detail below.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(9) Does any government entity or Public Official have any ownership interest in, other financial interest in, or act as an officer or employee of, the Company?

(10) Does any government entity or Public Official have any ownership interest, other financial interest, or act as an officer or employee of a third party (sub-contractor, vendor, consultant, etc.)?

(11) Does the Company have a code of conduct or other policy addressing business ethics, conflicts of interest, and/or anti-corruption compliance?

□ Yes □ No

If Yes, please attach a copy.

(12) Does the Company require your third parties (sub-contractors, vendors, consultants, etc.) to comply with any policies addressing business ethics and anti-corruption compliance?

□ Yes □ No

If Yes, please attach related materials.

(13) Does the Company conduct employee training on business ethics and anti-corruption compliance?

□ Yes □ No

If Yes, please attach related materials. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2020. . . . Corporation Name (Business Name) :

Prepared by :

Representative Director : (Seal) |

Appendix 2. Representative Pledge

|

(Third Party) Representative Anti-Corruption Practices Pledge

When conducting activities with Public Officials, in accordance with Article 15 of the Woori Financial Group Global Anti-Corruption Laws Compliance Manual, ____________ acting on behalf of Woori Financial Group pursuant to contract or otherwise shall not engage in any illegal or unethical actions and shall comply with the following items.

1. Name of Company (the “Company”) :

2. The Company carefully reviewed and completed the “Third Party Representative Questionnaire” dated ___________ and confirmed that there were no abnormalities in the responses.

3. The Company shall not do any of the following acts when conducting activities with Public Officials.

A. any act influencing or inducing any act or decision to do any act in violation of a lawful duty

B. inducing the recipient to violate his or her duty of loyalty to the execution of official business

C. offering, paying, or promising the payment of any money or anything else of value to secure any improper advantage for Woori Financial Group or the Company

D. “Public Official” means a person who falls in any of the following categories:

- officers and employees of the National Assembly, Courts, the Constitutional Court, Election Commissions, the Board of Audit and Inspection, the National Human Rights Commission, central administrative agencies (including institutions affiliated with the office of the President and the office of the Prime Minister) and their affiliated institutions, and local governments (excluding, however, fixed-term and contract workers who are not public officials under applicable public officials laws);

- officers and employees of public enterprises (government ministry-type, stock company-type, corporation-type);

- appointed public officials and candidates for public office;

- political party employees and officials;

- officers and employees of a public international organization, such as the World Bank or the United Nations;

- employees of sovereign wealth funds;

- other persons performing public duties on behalf of the above; and

- other persons deemed as Public Officials or equivalent to Public Officials according to local law in the applicable country

4. The Company has not been sanctioned by or received any summons from any governmental agency regarding Company’s violation of, or failure to comply with, any laws or regulations governing bribery, money laundering, or other corrupt practices.

5. The Company will comply with all applicable laws and regulations governing bribery, money laundering, and other corrupt practices so long as the Company has a business relationship with Woori Financial Group.

2020. . .

Corporation Name (Business Name) :

Prepared by : (Seal)

Representative Director : (Seal) |

Appendix 3. Anti-Corruption Provisions

(including contracts entered into by Representatives)

(Example)

Article XX

① [GROUP] and [COMPANY] shall each comply with, and shall compel any third parties performing services on its behalf in furtherance of the transaction to also comply with, all applicable laws concerning anti-corruption practices and the Woori Financial Group Global Anti-Corruptions Laws Compliance Manual.

② In carrying out activities for [GROUP], no officer, beneficial owner, employee, sub-contractor, or other agent of [COMPANY] shall offer, pay, promise to pay, or authorize the payment of any money to any Public Official for the purpose of an improper benefit.

③ [COMPANY] has not engaged in, or been sanctioned by any governmental or other agency for, bribery, money laundering, or other corrupt practices or behavior; and shall continue to comply in the future and shall promptly notify [GROUP] upon the occurrence of any non-compliant act.

④ In the case of any breach by [COMPANY] of item 2, [COMPANY] shall not object to any detrimental disposition by [GROUP], including bid exclusions, cancellation or termination of contract, discontinuance of transactions, and shall also compensate for any resulting damages.

Appendix 4. Charitable Contribution Pre-Check

|

Charitable Contribution Pre-Check

The following items have been completed and abnormalities have been checked for in accordance with the Group Global Anti-Corruption Laws Compliance Manual.

(1) Submission of written request materials related to contribution (requester or agency)

(2) Key Information

(3) Check Items

20 . .

Department :

Name : (sign) |

Appendix 5. Grants and Sponsorships Pre-Check

|

Grants and Sponsorships Pre-Check

The following items have been completed and abnormalities have been checked for in accordance with the Group Global Anti-Corruption Laws Compliance Manual.

(1) Submission of written request materials related to grant or sponsorship (requester or agency)

(2) Key Information

(3) Check Items

20 . .

Department :

Name : (sign) |

Appendix 6. Expense Payment Checklist

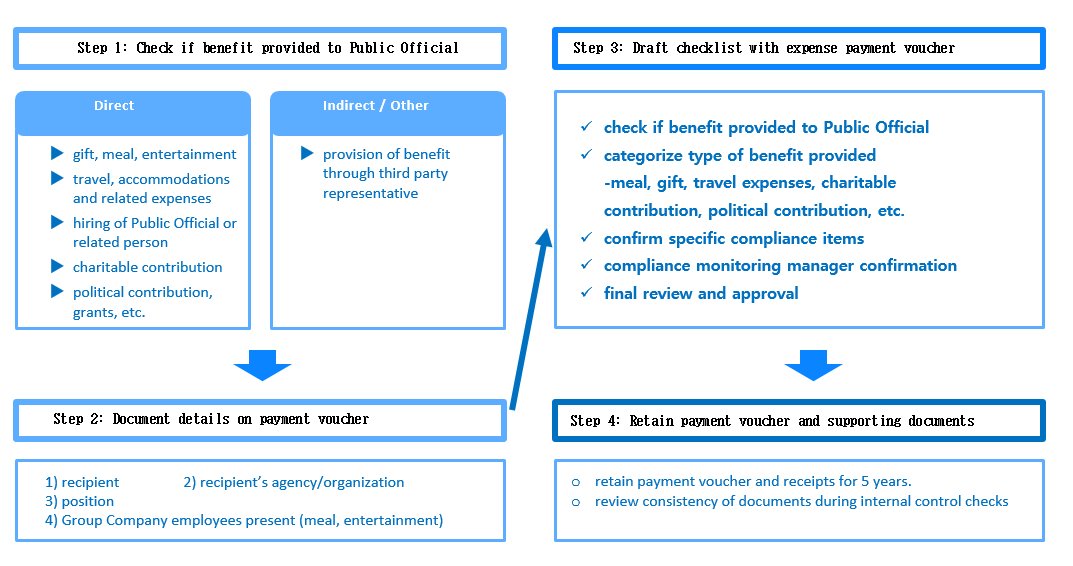

○ Checklist Drafting

- The accounting processing procedures set forth in the “Group Global Anti-Corruption Compliance Program” must be adhered to with respect to the voucher drafting, examination and execution of expense or fee payments to Public Officials, and the “Expense Payment Checklist” must be prepared when drafting the payment voucher.

[REFERENCE] Accounting Processing Procedures

Woori Financial Group adheres to the following accounting (expense, fee) processing procedures in carrying out the global anti-corruption work.

II. Global Anti-Corruption Laws Compliance Pledge

Woori Financial Group’s officers and employees do not tolerate bribery or corruption in any form, and all third party representatives conducting business on behalf of the Group (including Group Companies) must also comply with laws that prohibit bribery and other forms of corrupt conduct.

I will act in accordance with the following in compliance with global anti-corruption laws.

□ I will not give any bribe or other improper benefit to a Public Official to secure an improper business advantage.

□ I will provide gifts, meals, and other benefits to Public Officials within limits prescribed by law.

□ I will not seek any business advantage through an illegal request to a Public Official.

□ I will not give any employment-related preference to a Public Official or a Public Official’s relatives for purposes of a business advantage.

□ I will not make any charitable contribution as a reward or provision of benefit for favorable treatment by a Public Official.

□ I will not make any political contributions to secure a benefit for the Group Company.

□ I will not provide any bribes or other improper benefits to a Public Official through third party representatives of the Group Company.

□ I will consult with the compliance monitoring department in advance when the provision of a benefit would exceed limits permitted by law.

□ I will promptly report the discovery of any act of bribery or provision of improper benefit.

□ I fully understand and will comply with the Group’s Global Anti-Corruption Laws Compliance Manual.

Confidences will be maintained and no retaliatory action will be taken against any officer or employee or representative for making a report about illegal activity pursuant to Article 6 of the Woori Financial Group Global Anti-Corruption Laws Compliance Manual.

20 . . .

Confirmed by Position/Name : (Signature)